Payments

Making Payments

We are open from 9 a.m. to 5 p.m. on both the Long Island and New York City campuses.

We offer remote and in-person services Monday through Friday from 9 a.m. to 5 p.m. Thank you. Please visit Student Resources Office Hours for more information.

To expedite processing of your payment we encourage all payments to be made online via the Student Service HUB—Your Home for University Business—or mail your payment to the following address:

New York Institute of Technology Office of the Bursar

P.O. Box 392

Old Westbury, N.Y. 11568

If you need assistance with navigating the Transact Payments (Formerly known as CASHNet) Full-Service Payment Plan website or enrolling into a payment plan, please contact the Transact Payments Customer Care Center, Monday through Friday, 8 a.m. – 8 p.m. EST at 888.381.8054 (first choose option "1" then choose option number "2" for students and parents).

Pay Online

Paying online is easy! Just log in to your student account at the Student Service HUB. You may pay by credit card, eCheck/ACH, Flywire, TransferMate (formerly Pay to Study), or 529 College Savings Plan.

Need help? Check out this easy how-to video

Pay By Mail (New York City and Long Island Campuses)

Include your student ID number and send payment to:

New York Institute of Technology Office of the Bursar

P.O. Box 392

Old Westbury, NY 11568-8000

Pay In-Person

For limited in person hours in the Long Island campus and to view hours and locations for the Office of the Bursar.

Long Island

Harry Schure Hall, 1st Floor

516.686.7510

New York City

16 W. 61st St., 1st Floor

212.261.1620

** Please do not mail payments to these locations**

Payment Due Dates

100% of Tuition, Fees, and Housing (if applicable) is due:

- Fall Semester: August 1

- Spring Semester, including Intersession: January 1

- Summer: May 1

- College of Osteopathic Medicine: View Dates

- Vancouver students: View Dates

Acceptable Forms of Payment

- Credit card (American Express, Discover, MasterCard, Visa)

- eCheck: A convenient payment option.

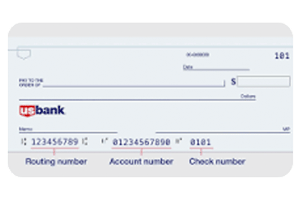

- Simply enter your U.S. checking or savings account information and payment will be made electronically. The routing number is the nine-digit number printed in the bottom left corner of each check. Your specific account number (usually 10 to 12) is the second set of numbers printed on the bottom of your checks.

- View Convenience Fees »

- Payment Plans: Pay your tuition (the amount remaining after financial aid), in manageable monthly installments. It takes only a few minutes and you pay just one low fee at the time of enrollment.

- 529/College Savings Plan (Students can now choose to make a 529 payment through a direct pay link from select 529 plans. For participating plans, sign into the Student Service HUB and choose the 529 payment option. Once you link your participating 529 plan, you can request your payments to be sent to New York Tech electronically. Electronic 529 payments save students processing time, provide real-time validation and account posting, quicker receipt of funds, and elimination of over payments. There is a $10 processing fee charged by Transact Payments for 529 disbursements.)

- Check (Processed as an Automatic Clearing House payment; funds will be electronically deducted from your account)

- Money order/travelers checks

- Cash (ID required for all cash payments). **Please see note under "Other Information" regarding cash transactions.

Avoid Additional Fees

Late Payment Fees

- Late payment will be charged for payments made after the August 1 due date.

- Late payment fee will be charged for payments made after the January 1 due date.

Late registration fee (all programs): Returning students may register during registration periods up to the first day of the Fall or Spring term without penalty.

LATE REGISTRATION FEES WILL APPLY TO ALL RETURNING STUDENTS THEREAFTER.

The late registration fee does not apply to newly enrolled students.

Collection Agency Fees

Please refer to the Course Catalog for information on collection agency fees.

Overdue Payments PenaltiesTax Forms and Other Information

On-Campus Marketing of Credit Cards to Students

New York Institute of Technology prohibits the advertising, marketing, or merchandising of credit cards to students on campus.

VIEW FULL POLICYIRS Tax Forms

Form 8300 Cash Transaction Reporting

New York Tech is required to report to the IRS the receipt of cash in excess of $10,000 in a single transaction (or two or more related transactions) that is received in the course of the university's trade or business.

Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business, must be filed with the IRS for each reportable transaction by the 15th day subsequent to the transaction.

Please refer to IRS Publication 1544 for information on reportable transactions.

If you have any questions regarding this federal reporting requirement or the referenced documents, please contact the Office of the Bursar at (516) 686 7510.